Uncategorized

How to use Ledger balances for smarter financial decisions

Wave goodbye to financial guesswork! Ledger balances are your secret weapon for smarter budgeting and forecasting, slashing overdraft risks and boosting your financial clarity.

Just a heads up, if you buy something through our links, we may get a small share of the sale. It’s one of the ways we keep the lights on here. Click here for more.

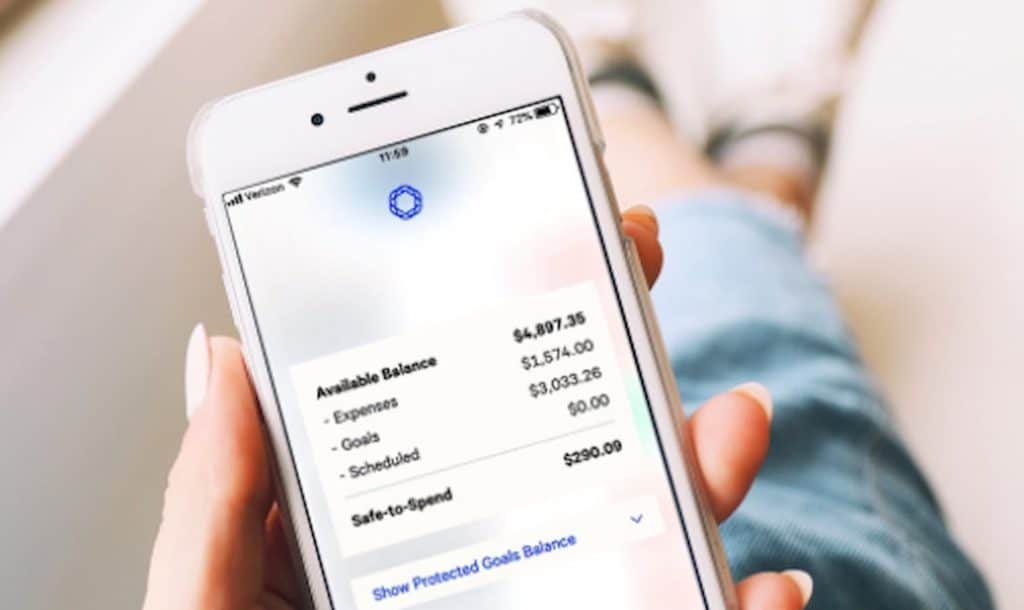

Are you confident that your account balance tells the whole story? Relying on a single snapshot of your account can be misleading in personal and business finance.

Understanding ledger balances, the actual record of cleared financial transactions, can dramatically change how you approach budgeting, forecasting, and financial decision-making.`

Understanding ledger balances, the actual record of cleared financial transactions, can dramatically change how you approach budgeting, forecasting, and financial decision-making.

The difference between a stable financial future and recurring overdraft fees might lie in understanding ledger balance vs available balance. Let’s explore how ledger data can sharpen your cash flow insights and help you plan confidently.

Understanding Ledger Balances

A ledger balance reflects the actual amount in your account at the end of the previous business day, including all cleared credits and debits.

It provides a more stable and reliable financial snapshot. In contrast, the available balance may consist of pending transactions that haven’t yet settled and could change without notice.

This distinction is more than technical — it’s strategic. With ledger balances, you work with verified financial facts rather than fluctuating estimations, helping you make more grounded financial decisions.

Why is this important?

- Accurate cash tracking: What has been cleared helps determine real payment capability.

- Prevention of overdrafts: As much as possible, do not overlap the expenses with the project, but spend the money according to the initial estimation.

- Improved forecasting: Get accurate and valid records of your spending patterns over time.

Practical Applications of Ledger Balances

Your ledger isn’t just a record — it’s a forecasting compass. Used effectively, it reveals trends and equips you to stay ahead of cash flow issues.

Monitoring Cash Flow

Monitoring your ledger balance regularly helps you spot patterns in spending and income. This kind of financial visibility enables better planning and stability.

As reported by the reports on guaranteed income programs, predictable cash flow, even modest, can significantly improve how individuals manage expenses, reduce stress, and build financial cushions.

Similarly, tracking your ledger balance gives you the insight to anticipate shortfalls and maintain control.

Budgeting and Forecasting

Since ledger balances reflect confirmed activity, they form a reliable base for building monthly or quarterly budgets. No more guessing based on pending transactions — just actionable data.

Avoiding Overdrafts and Fees

Relying on the available balance alone can be risky. If your pending charges haven’t cleared, you might unknowingly overdraw. With the ledger balance, what you see is what you truly have.

Tools and Techniques for Leveraging Ledger Balances

No matter your level of tech-savviness, there’s a way to manage your ledger that fits your needs. Whether you’re a spreadsheet aficionado or prefer intuitive software, the goal is clarity and consistency.

Financial experts emphasize that everything from Excel to platforms like QuickBooks can help users stay organized and make smarter financial decisions.

Manual Tracking Methods

- Use Excel or Google Sheets to log cleared transactions daily.

- Reconcile weekly against bank statements for accuracy.

QuickBooks Online is a comprehensive financial management tool, offering features such as invoicing, expense tracking, and real-time inventory management, suitable for small businesses and freelancers alike.

- QuickBooks Online supports customizable invoicing and real-time bank synchronization.

- The software integrates with 650+ business applications and provides detailed financial reporting.

- Mobile app enables instant expense tracking and receipt scanning.

- Platform offers advanced expense categorization and profit analysis tools.

Financial Software Solutions

Innovative tools like Cash Flow Frog automatically interpret ledger data and build forecasts, offering a real-time snapshot of your financial health.

Working with Financial Institutions

Most modern banking apps distinguish between ledger and available balances and offer alerts to notify you of balance changes, so you’re always in control without opening a spreadsheet.

Best Practices for Smarter Financial Decisions

To make the most of your ledger balance and support smarter financial decision making, consider these habits:

-

Establish a Routine: Check your ledger balance at least twice a week as a regular habit to maintain awareness of your financial position and catch irregularities early.

-

Distinguish Between Cleared and Pending: Understanding the difference between cleared and pending transactions ensures that decisions are based on actual, available funds, not assumptions.

-

Use Forecasting Tools: Platforms like Cash Flow Frog help turn your ledger data into meaningful projections, enabling more innovative budgeting and more confident planning.

- Educate Everyone Involved: Ensuring your team or household understands how ledger balances work promotes aligned financial decisions and reduces the risk of miscommunication.

In Conclusion

Understanding and utilizing your ledger balance is non-negotiable in financial decision-making.

It empowers you to budget accurately, forecast confidently, and make decisions based on reality, not assumptions.

Whether you’re someone working to rein in personal spending or a business owner trying to understand where your cash is going, understanding your ledger balance is a decisive first step.

Tools like Cash Flow Frog don’t just show you numbers — they help you interpret them, revealing patterns and possibilities that can guide real, confident decisions for the future.

What’s your take? Have you used ledger balances to transform your financial planning? Share your experience in the comments — we’d love to hear how it’s shaped your strategy.

Have any thoughts on this? Drop us a line below in the comments, or carry the discussion to our Twitter or Facebook.

Editors’ Recommendations:

Disclosure: This is a sponsored post. However, our opinions, reviews, and other editorial content are not influenced by the sponsorship and remain objective.